"We have an ageist federal government"

We need more Baby Boomers to call out generational unfairness.

Recently Gen Squeeze supporter Mary Peirson (MD, CCFP) wrote to us, “We have an ageist federal government – one that favours older Canadians and retirees in particular.”

We’re very inspired by messages like this from older Canadians, who are concerned about the harmful intergenerational legacy Canada is poised to leave. And they want to do something about it!

As Mary puts it, “I am a boomer and I find it embarrassing and uncomfortable that our government appears to be blind to these issues of equity and fairness.”

We need more leaders like Mary from across the age spectrum to make clear that today’s affordability, debt and climate challenges are NOT ‘youth’ issues. These are issues of intergenerational fairness and solidarity.

We’d like to share Mary’s take on some key policies propping up generational unfairness: Old Age Security, universal drug benefits for Ontario seniors, pension income splitting, and the principal residence tax exemption.

Old Age Security (OAS)

Canada’s guaranteed annual income for seniors

What Mary has to say:

“This payment to seniors comes from general tax revenues… As such it is a direct transfer from working people (the vast majority being much below age 65) to retirees. The income at which OAS begins to be clawed back is too high given costs for seniors are generally lower in retirement. And seniors nearly all organize retirement income to maximize OAS, even if they have substantial wealth and assets… OAS should be means tested (means = total wealth including all investments, income and hard assets).”

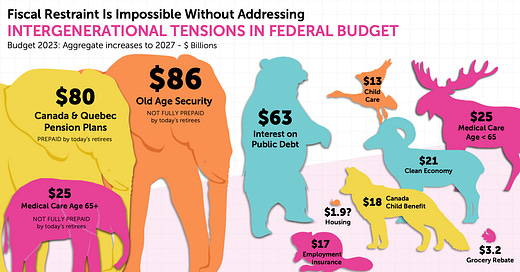

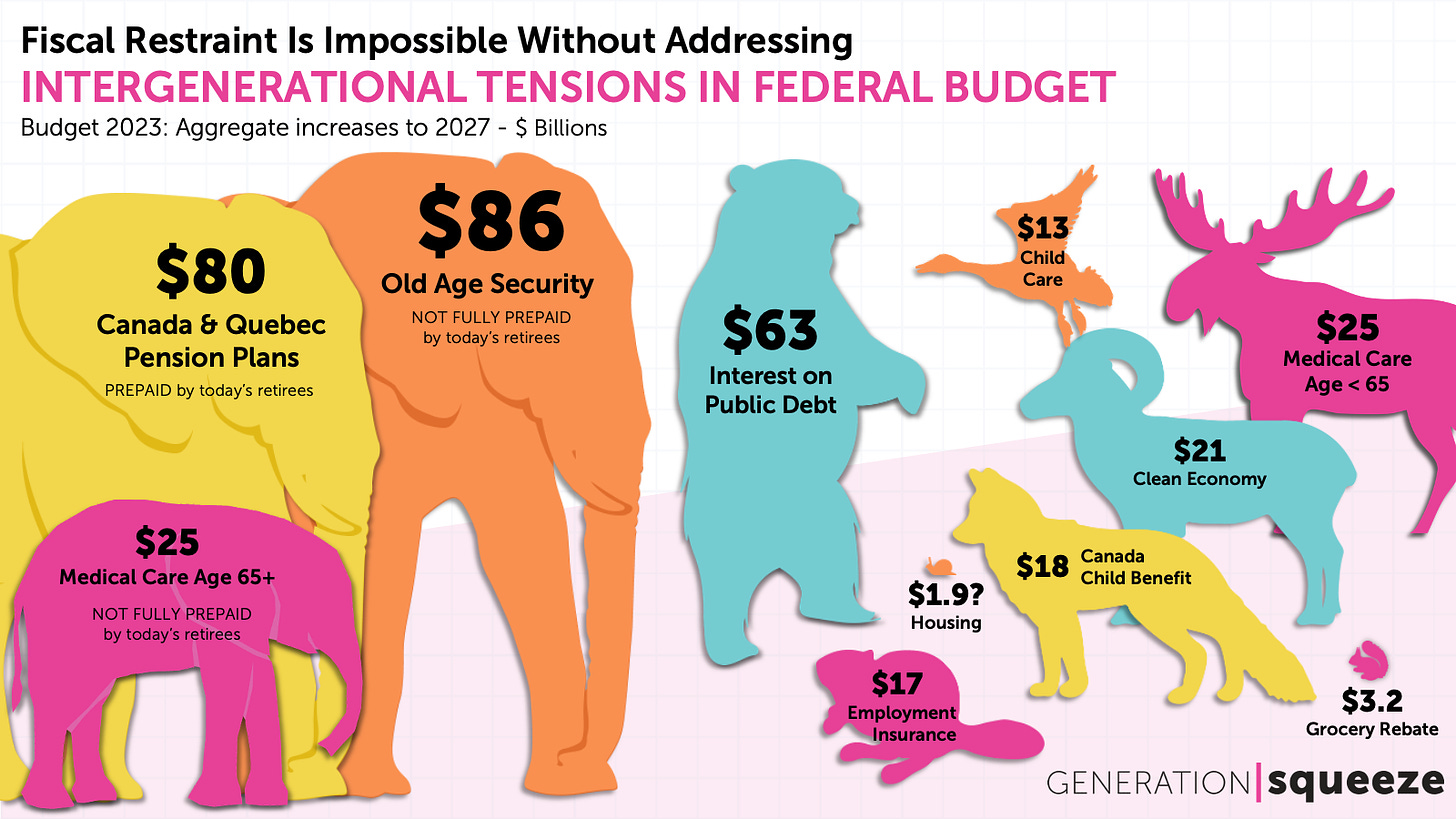

Mary’s analysis is right on the money (no pun intended). OAS is the elephant-in-the-room in federal budgets, consuming a huge share of our tax dollars. Because successive governments haven’t adapted program financing, OAS has become a key driver of ballooning federal debt, which will be inherited by future generations.

Seniors remain eligible for full OAS benefits even with $81k in annual income. That’s over $14k more than Canada’s median income from full-time work. In contrast, the Canada Child Benefit starts being clawed back at just $33k in income.

Universal drug benefits for Ontario seniors

What Mary has to say:

“This is also ageist (anti-youth) and regressive. This program should be income tested with the option to buy into the system (regardless of health status) if net worth is too high to receive this program for free. And the program should be available to all Ontarians on a means-tested basis with the option to buy in.”

Evidence suggests that adding prescription drugs to our publicly funded medical system can improve health outcomes. However, the spiralling costs of medical care already risk crowding out important investments in the things that help keep us healthy and well, like safe homes and clean air and water. While it’s no surprise that medical care pressures are increasing as our population ages, governments haven’t engaged Canadians in a conversation about how to cover these additional costs. Younger people are already paying more in taxes than did previous generations for medical care for their aging loved ones. It’s timely to also consider whether some more affluent seniors are also well positioned to contribute more.

Pension income splitting

Allows seniors with high pension earnings to transfer a portion to a spouse with lower earnings, thereby reducing the overall amount of taxes paid by the couple

What Mary has to say:

“This policy is both ageist (anti-youth) and discriminates against singles. This policy is particularly regressive as it minimizes taxes for all seniors (especially wealthy seniors) while ignoring working families who often have large income disparities during child rearing years. And being single, or widowed should not be punitive from a taxation perspective.”

Mary is right to question the wisdom of pension income splitting. It costs governments $2B a year in foregone tax revenue – more than federal spending on housing, even in the midst of an affordability crisis! This spending doesn’t even help the seniors who might need it. Most gains from pension income splitting go to the richest 40% of seniors, and 7 in 10 don’t benefit at all.

Seniors also benefit from two other questionable tax loopholes. The Age Credit gives a tax break to any Canadian age 65+ with an income of up to $92K. This credit costs $5B a year in foregone revenue – just about equivalent to $5.6B in federal spending on child care in 2023-24. The Pension Income Credit allows seniors to automatically shelter a portion of their pension income from taxation regardless of total income, at an annual cost of $1.4B.

Principal residence tax exemption

A.K.A the home ownership tax shelter (HOTS)

What Mary has to say:

“This tends to favour older individuals who were able to acquire a home when it was relatively more affordable and have seen a huge tax-free windfall as housing prices have skyrocketed. It would make sense to eliminate or curtail this particular tax exemption and expand Tax Free Savings Account contribution room so that all members of society might be able to equally benefit from tax exempting programs. In particular, young private sector workers who don’t have pensions and may never be able to afford a home (or afford it much later than their parents/grandparents did).”

When home values rise, HOTS ensures that wealth gained by home owners is sheltered from taxation. Wages from hard work are taxed more than housing wealth windfalls gained while home owners sleep and watch TV. Home owners have gained an additional $3.2 trillion in housing wealth since the mid-1970s – most of it tax free.

HOTS cost the federal government a whopping $10 billion in 2022. Provinces lost billions more. It is by far the largest housing subsidy Canada offers… and we’re giving it to those who already own homes! Not to those who can’t afford a home, as either renters or owners.

All of the pressures Mary flags are compounded by the fact that today’s seniors are living longer. During their working years, Baby Boomers paid taxes when there were 7 working-age adults for every retiree. As retirees, Boomers now expect the same or better services when there are only 3 working-age residents for every senior. The consequences for intergenerational fairness – not to mention young people’s tax and debt burdens – are enormous.

As Mary affirms, “the math is unsustainable.”

Thank you, Mary! You are truly a generational fairness maven.

Want to join Mary?

Let us know if you’re interested in taking the next step.

Want to learn more about generational unfairness in budgets?

Check out our Hard Truths episodes with Kevin Milligan, Sean Speer and Bill Robson.

"Whatever problems we have now, they're just growing tremendously...Economists, social scientists, academics, regular folks out there -- they kind of know that the population is aging, but I don't think they know how much that's going to matter over the next 10 years."

- Economist Kevin Milligan on Hard Truths

Or if you’re short on time, Canada’s Bad Budget Bunny can help:

We’ll said Glen - thank for your cogent comments! I entirely agree with you that voter engagement (and voting period) among young people is critical to a fairer future for all. I believe that lowering the voter age is a smart step towards that goal.

Here in Ontario we finally changed the high school curriculum to include basic financial literacy. How great would it be if the civics course (required in Ontario) included voting (real voting if there happened to be election) but also learning about how to evaluate party platforms, where to get unbiased information such as the GenSqueeze voting guide. If we could get teens registered to vote before leaving high school that would be ideal. Other countries such Nicaragua, Scotland, Isle of Man, Guernsey, Ethiopia, Ecuador, Cuba, Brazil, and Austria already allow voting at age 16. Voting is a skill - it can feel alien if you’ve never done it before so it’s important to demystify this incredibly important civic duty and privilege. Those given the opportunity to vote at 16 are more likely to vote in early adulthood. Engagement in the political process is critical if young people are to have influence and help shape a fairer future.

And then there’s climate change... young people are going to be on this planet a lot longer than us boomers and they deserve a safe and healthy environment. But climate policy requires commitment and a long term plan and the election cycle is too short. We need more young people who are climate minded in the halls of power for long periods of time and that will only happen if we have more engagement from young people in the political process.

I think young adults are often overwhelmed (rent, student debt, climate worry ...) and this state of being overwhelmed leads to a sense of hopelessness and disengagement. And it also makes young people vulnerable to populist sentiments. So let’s engage them before this difficult stage of life is upon them. Let’s get them voting earlier and impress on them that their vote counts!

As a boomer I continue to raise my generational squeeze concerns whenever and wherever I can. We have a lot of institutional structures in place that no longer serve the needs and reality of our times. Time to move the dial and talking openly about this ie. the generational inequity we’ve allowed to develop over decades. Boomers like me want to observe the campground rule - leave this place better than we found it. And there’s a fair bit of work to be done if we’re going to do that.

Thanks to Paul Kershaw and his team at Generation Squeeze for working towards that goal and for creating this public forum.

Excellent Paul! Well answered. In my second post and letter to you I stressed all of us needing to fight for equity. Astra Taylor’s Debt Collective…her practical approaches-Solidarity solutions for those who can’t and won’t pay debt come to mind. I am sure Astra Taylor would be most supportive of Generation Squeeze too! She is giving The Massey Lectures on CBC this November.

It would be great if she drew attention to Generation Squeeze when she delivers her lectures.

Astra is a fellow of the Shuttleworth Foundation for her work on challenging predatory practices around debt. The Shuttleworth Foundation provides funding for people engaged in social change. Possibly a good resource for generation squeeze?

My full posted comment was:

Closing loopholes-simplifying the tax code- ridding of tax shelters and installing a truly progressive tax code- taxing wealth giving benefits to every generation.... thinking along the lines of Universal Basic Income-Universal Basic Needs being met not just for some but for all. Young people without a sense of security are vulnerable to becoming alienated, apathetic and cynical. They are our future. Future policy makers. Wounded citizens tend to be reactionary. And those that succeed in a unfair system are easily inclined to think: “I made it in spite of the unfair system-so it’s not so bad.” Some even grow in their belief that government should get out of the way and let the marketplace decide and lower taxes-supports-government interference for those too lazy to make it. Thus, the popular appeal of Pierre Poilievre.

Getting at the inequality of the generational squeeze will require all of us becoming far more politically active citizens than we are. The squeezed need to vote. Voter turnout in Canada is lowest for young voters. Older generations vote. Public policy reflects those that vote, organize and pressure in solidarity. We all need to pressure and support the most equity driven politicians-parties. Too many young people vote reactionary-vote Conservative reflecting sentiments that government supports don’t work. My efforts are towards making the NDP and Greens more equity driven- to get them off the fence and really stand up to be an alternative. (voters in Alberta reported finding it hard to distinguish the NDP policies from the Conservatives)

So often is the case that young people are overwhelmed from lacking the Security- financial security- lacking the FREEDOM that seniors have to be politically active. Scrapping to get by is no way to get a healthy participatory democracy...which is why I argue for a Universal Basic Income. It would reduce reactionary politics.

At the root of the problem is reactionary narrow interest group politics/policies that keep us too dumb for democracy-for fair play.