Housing round-up: Canadians are realizing that “mom and pop” investors are part of the problem

Plus, our interview with a mayor priced out of the community she leads, and an essay we loved about housing grief over the holidays

Today we’re sharing our latest Hard Truths episode and two recent articles that we really enjoyed. It seems that some of the ideas we’ve been working to spread are starting to take hold. Both of these articles touch on key Gen Squeeze themes, like how our addiction to high and rising home prices is harmful to younger people, newcomers to Canada, and renters of any age.

Let’s get into it.

Millennial Mayor Natasha Salonen of Wilmot, Ontario, made national news last summer: she can't afford to live in the community she leads. Mayor Salonen showcased how younger Canadians are being priced out of their hometowns. But she also reminded us of the power of speaking out. By talking openly about her experience with housing, she's reassured many younger people living with parents that they're not alone, and she's helped many older homeowners understand how unaffordable housing is harming their communities.

"Every idea — and even every rule that governs us now — came out of an idea that somebody had in an initial conversation," she said. "I think one of the biggest powers that people have as individuals is the ability to have conversations."

Feeling inspired to share your story? We want to hear how generational unfairness touches your life and the lives of those you love:

I Spent the Holidays in Inheritance Capitalism

Christopher Cheung’s article in The Tyee struck a chord with me. He so eloquently captures the feelings that I, and probably many other younger Canadians, had over the holidays.

“The culture shock hits harder with every passing Christmas when I make the rounds for family dinners and am face to face with so much real estate.

We don’t host. None of us millennials do, not when our elders are the ones with actual land to their names. In our one-bedroom apartment, the Christmas tree is a condo-friendly thing purchased from Ikea to be displayed on a tabletop. But the real centrepiece of our living room is the winged drying rack that has made a permanent home there, ornamented with socks and underwear. There is barely enough elbow room for us, let alone a parade of extended relatives.”

How we would love to be the ones inviting our loved ones for a delicious meal. But for many of us, it’s impossible in our cramped living quarters. Who wants to tell their aunt, uncle, or worse yet a grandparent, that their seat for dinner is a cushion on the floor beside the drying rack?

Christopher rightly observes that Millennials who own any home at all can count themselves as lucky within their generation — even if they lament that they lack the space to host family gatherings. Just 16% of people born in the 1990s are homeowners, compared to 67% of Canadians overall. (Having parents who own a home gives Millennials a big leg up, as CBC’s Andrew Chang explained well in this About That video.)

“We took space for granted when we were children because we thought it came with houses, and houses came with being adults. Now that we’ve grown up, the basics of our parents’ generation seem like luxuries to us.”

The article concludes with a reflection that says a lot about the failures of Canada’s housing system.

“I remember a family visit to a relative’s 8,000-square-foot house. My grandfather, impressed, had a few words for me and my young cousins. ‘If you work hard, one day you’ll have a house like this too’.”

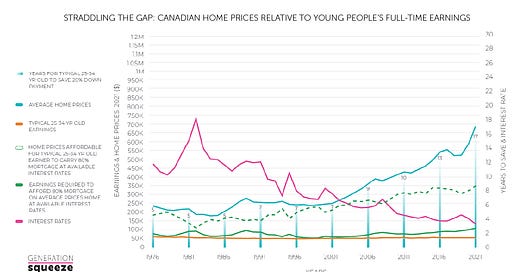

Hard work might have been enough in the past, but it no longer pays off today the way it did for previous generations. Today you can forget 8,000 — or even 1,000 — square feet. As Christopher mentions in the article, Generation Squeeze research shows that in 1976, it took a typical young Canadian five years of full-time work to save up for a 20% down payment. Today, it would take 17 years!

Housing grief is real for younger people struggling with rising prices, whether as aspiring owners or renters. Sharing your story about what this grief means for you is a powerful way to remind homeowners and political leaders about the real life costs of our broken housing system.

Social Capital Partners: To solve the housing crisis, we need to do something about ‘mom-and-pop’ investors

Jon Shell, Managing Director of Social Capital Partners, hit it on the head with this opinion piece in the Globe and Mail.

For years, we have been advocating for a comprehensive response to our housing affordability crisis, pointing out the inconsistencies in the widespread mistaken belief that supply is a silver bullet. It’s exciting to see others like Jon spreading the same message.

“A recent Bank of Canada report made waves when it revealed that 30 per cent of residential home purchases in the first three months of 2023 were made by investors and not people who intended to occupy those homes. The figure was less than 20 per cent in 2014.

Growth in investor demand is pouring jet fuel on our housing crisis.

But while there finally seems to be broad political consensus for an ambitious program to increase the supply of housing in Canada, a comprehensive demand strategy that addresses the overabundance of investors has been conspicuously absent.

This needs to change.

The opportunity is huge. The impact of cutting investors’ share of future home sales in half, to a level not significantly lower than it was 10 years ago, would be both immediate and dramatic. It would open up about 75,000 homes next year for first-time homebuyers and, as the supply of homes ramps up, could make upward of a million available over the next decade. All with no additional shovels, and no additional costs.”

Jon also correctly identifies the obsession of everyday Canadians with real estate investment as a contributing factor to our housing affordability problem.

This issue is largely political. The biggest investors — by far — in residential real estate are individual Canadians, or so-called “mom-and-pop” investors. According to Statistics Canada, they own 23 per cent of all condos and 11.2 per cent of all houses in Ontario, which is more than both corporate and foreign investors combined. Other provinces have similar rates.

Governments have already implemented policies focused on reducing bans from “easy villains” like foreign investors — part of what’s needed to curb harmful housing demand, as noted in Gen Squeeze’s comprehensive housing solutions framework. But some of the critical next steps will require many regular Canadians to take a look in the mirror and reflect on how they are contributing to (or benefitting from) rising home prices.

Jon notes that most Canadians recognize that demand from individual investors is driving up prices, and want something to be done about it:

A recent Pluriel Research poll showed that 80 per cent of Canadians believe investors are driving up the cost of housing, and 75 per cent blame mom-and-pop investors specifically. Continued failure to dampen demand may now hold real political risk, as 65 per cent of Canadians support policies to limit investment in residential housing.

Despite the fact that “even moms and pops want government to reckon with mom and pop,” our elected leaders largely continue to ignore individual investors as a contributor to high home prices. If we want this to change, we can’t just agree silently on the sidelines. We need to get into the game and make ourselves heard!

Happily, with government budget season just around the corner, it’s a good time to get the ear of your provincial and federal representatives. We urge everyone to remind governments of all stripes that housing should be for homes first, and investment only second.

We must stop the residential housing investment. Housing is for living, not for investing.

Kareem see my email I sent you on how Reverse Mortgages are another kick in the teeth to a generation being squeezed