Busting Myths: "Housing Hell" and Health

Why good health requires more than medical care, and fact-checking the Conservative leader

We have a jam-packed newsletter for you this week. We’ll be discussing articles in two publications:

The Monitor: The social solution to Canada’s health care problem

The Tyee: Fact-checking Pierre Poilievre’s latest housing video

As this year winds up, we also want to thank you all for your ongoing attention and participation here on Substack. We don’t offer paid subscriptions and rarely ask for donations, because so many people in our network are already feeling squeezed. But if you have the means, we hope you'll consider powering another year of our work with a donation. As a non-partisan charity, we won’t accept funding that restricts our independence in carrying out research and analysis. That means individual donors are a critical base of support on which we can depend.

Now, let’s get into it.

The social solution to Canada’s health care problem

Concerns about Canada’s medical care system have consumed us in 2023. Yet all the stories about wait times, whether we have enough doctors, or the pros and cons of private medical clinics, are missing a key part of the equation. Health doesn’t begin with medical care. It begins where we are born, grow, live, work, and age. This means that Canadians will "Get Well" when we grow investments in safe and affordable homes, living wages, quality child care and schools, and a healthy environment, more urgently than we grow spending on medical care.

As provincial and federal governments were haggling over the latest $200-billion investment in medical care, we launched the Get Well Canada alliance to call on elected leaders to better balance how they invest in wellbeing. Get Well Canada rallies researchers, community leaders, and medical professionals to fulfill the promise of Canada’s commitment to health care by completing our health system.

As the father of Canada’s public medical care system recognized, medical care wasn't designed to create health—it was designed to treat people once they're already sick. The medical care we receive accounts for only a small part of our health. Health science has repeatedly confirmed that social conditions matter more.

Recent polling data shows that most Canadians already recognize this. As Paul wrote in the G&M:

Budgeting more for medical care may be viewed as a vote-getter, but recent online polling by Research Co. for Get Well Canada shows that it’s time for a course correction. Across Canada, 78 percent agree that “So long as Canadians can’t access safe homes, good incomes, quality child care, and a healthy environment, our medical care system will never be enough to prevent people from dying early.”

To dig deeper, check out the most recent edition of The Monitor magazine from the Canadian Centre for Policy Alternatives. The theme is “The social solution to Canada’s health care problem”, and it features articles from Gen Squeeze’s Andrea Long and Paul Kershaw, along with other Get Well Canada allies.

The Tyee: Fact Checking Poilievre’s ‘Housing Hell’ Video

“Paul Kershaw can’t help but be a little flattered by Pierre Poilievre’s latest effort to reach young voters. The Conservative leader’s YouTube video — clocking in at 15 minutes and 330,000 views so far — uses many of the same housing messages developed by Generation Squeeze.”

How can we not love an article that starts off like this? Jen St. Denis’ recent piece puts Pierre Poilievre's “Housing Hell” video under the microscope. It’s a great read, and we thank Jen for drawing attention to the fact that the Conservative leader is using some of our long-standing housing messages. With both the Federal Conservatives and Federal Liberals taking pages out of the Gen Squeeze playbook, it’s starting to feel like our ideas are taking hold.

Unfortunately, the video also makes clear that the Conservative leader is not on board with our entire housing policy solutions framework. As Jen puts it, he instead offers a “simplistic explanation” of the housing conundrum we are dealing with today – and what we need to do to fix it.

The video starts with Poilievre claiming that “something new and strange is happening in Canada” – referring to the housing crisis. Most of the rest of the video is spent explaining how Trudeau caused this ‘new’ problem with big deficits and red tape.

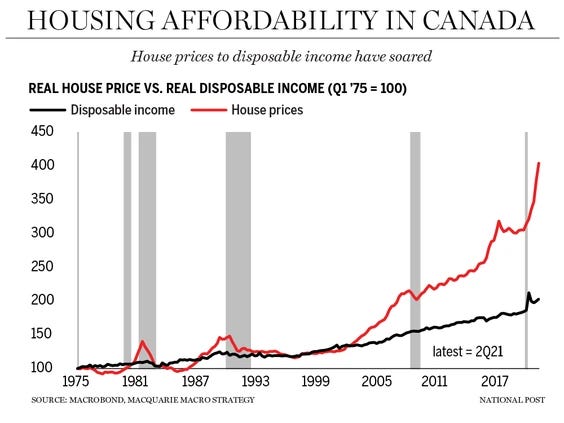

While Poilievre is tapping into very real grief about unprecedented housing unaffordability, it’s misleading to place all the blame on Trudeau for an issue that has been long in the making.

For example, as Gen Squeeze supporter Valerie pointed out in our Substack chat, Poilievre conveniently focused on ownership costs, as measured by the percent of the average family income required to make a mortgage payment on an average detached house. Ownership costs have spiked over the last couple of years under Trudeau, in large part due to higher interest rates.

A more accurate picture is painted by the chart below, which illustrates how house prices and incomes started to diverge long before Trudeau took office. This dovetails with Gen Squeeze’s long-standing efforts to sound the alarm about the growing gap between young people’s earnings and home prices in our Straddling the Gap series.

So what is Mr. Poilievre missing when he points the finger at the PM? As Jen explains in the article, the growing disconnect between home prices and earnings has its roots in policy decisions made in decades past that are now coming back to haunt us. Three are especially notable.

First up is the cheap credit system. Way back in 1949, Statistics Canada decided on a measure of housing inflation that ignored the size of the average down payment one needs to save to get into the market, and the value of the mortgage one needs to borrow. The result of this flawed inflation measurement approach is that inaccurate signals were sent to the Bank of Canada, contributing to monetary policy that fuelled the dark side of access to cheap credit.

Gen Squeeze has argued for years that monetary policy plays a role in determining property values. It was difficult to get any traction behind this idea before interest rates started rising last year, cooling the housing market. But now it’s exciting to see others (like Jen) recognize how low-interest rates contribute to rising home prices:

“To counter that rising inflation, the Bank of Canada raised interest rates — leading to higher mortgage rates, something most homeowners hadn’t experienced because interest rates have been very low for the past two decades. Those low interest rates were a key factor in rising home prices over the past 20 years.”

Second is the home ownership tax shelter (HOTS), created by Ottawa in 1972. The HOTS shelters from taxation the wealth gained by homeowners generated by rising home values – a policy decision that enabled our cultural addiction to high and rising home prices, and incentivized everyday households to treat housing not just as a place to call home, but also as a way to get rich.

It’s one thing to build modest housing equity by taking on a mortgage and paying it off over 25-30 years. It’s another thing altogether to hope that home prices double, triple or quadruple. A growing gap between home prices and earnings creates wealth windfalls for current owners, and unaffordability for those who follow – precisely the scenario we are witnessing across Canada today.

Last but not least is the federal government’s retreat from investing in non-profit housing. As Jen observes:

“...you have to go back to the 1980s to get to the root of the housing crisis, when two successive Canadian governments — one Conservative, the other Liberal — ended federal housing programs that had built thousands of units of affordable housing. Governments switched to supporting Canadians to enter the housing market as homeowners, pushing the idea that a home is not just a place to live but a savvy investment.”

A strong supply of housing priced below market rates is critical for affordability. Unfortunately, since previous governments got out of the business of funding this housing, deeply affordable housing is in scarce supply.

Whichever party headed into office in Ottawa following the 2015 election, would have been left holding the bag for these 3 short-sighted past policy decisions. The bag is very heavy now.

To be clear, none of that gives a free pass to the Trudeau Liberals. As we mentioned when discussing intergenerational tensions in the Fall Economic Statement, they could and should have done much more to rein in runaway home prices. But Poilievre’s focus on blaming Trudeau distracts from the root causes of the problems we are dealing with today.

That’s all for this time, thanks for reading!

You are on the right track Paul.

Back when I bought my house 22 years ago I purposely bought a house that I could easy afford and I paid it off quickly. My friends bought bigger house with large mortgages. I thought that I was the smarter one looking at my house as more of a need and liability. I invested in the stock market. My friends have now made a fortune on their homes based on what I assumed was wrong thinking -looking at your house as a sure way to get rich.

They have done better than me who saved and invested in what traditionally was the best investment- sound businesses on the stock market. Even my accountant advised me to by a second home as an investment property a few years ago. I didn't because because it went against my thinking and needs. The housing bubble needs to burst so that young people can get homes but also to stop the cycle of Greed towards housing. Government building affordable housing and limiting the amount that these government subsidized affordable housing can be resold at to ensure these homes stay affordable is key to my mind .

Excellent work Kareem, Paul, Andrea and Megan!

We have lost sight of real values in the financialization of our economy. Nowhere is this more felt than in turning owing a house into an investment asset to maximize wealth leaving so many unable to afford a home. I gladly give 365 dollars to Generation Squeeze because I appreciate my home 365 days a year!