Greedy Galen Weston Isn't The Only Reason Our Economy Is Out Of Balance

Fixing our problems will require wrestling with hard truths about our government budget deficits

At Generation Squeeze, we often talk about how the problems we face are too complex to be solved with a single solution — or as we like to say, there are no silver bullets; we need a silver buckshot. Long lines for medical care, growing climate risks, and unaffordable housing are the results of numerous past policy failures. So just like building more homes, alone, won’t solve our affordability issues, there isn’t one simple solution to ballooning government debts.

Paul’s latest article in The Globe and Mail puts these deficits front and center, exposing a hard truth behind persistent and growing shortfalls in the public purse: the rising costs of protecting healthy retirements for Canada’s aging population. As the group with the most wealth and the lowest levels of poverty, Paul asks older Canadians to “help make talking taxes sexy again.”

We need their help because we can’t curb growing government deficits by relying solely on easy-to-swallow measures like asking the super-wealthy to pay more taxes. Getting budgets back in balance means thinking about what we all contribute — and who might be in a position to pay a bit more. That’s a topic many people don’t like to discuss.

Death and taxes. The only things you can count on, so the joke goes.

But if my experience is any indication, talking publicly about taxes now means you are likely to attract nasty notes from people wishing you harm. That’s not funny, and it’s counterproductive when governments of all ideological stripes run deficits outside a recession – such as the federal Liberals, Ontario Progressive Conservatives, the B.C. NDP. Deficits generally are no longer partisan or ideological. They reflect a structural problem in government budgets.

The 2024 BC Budget bravely acknowledged how changing demographics have contributed to these structural deficits:

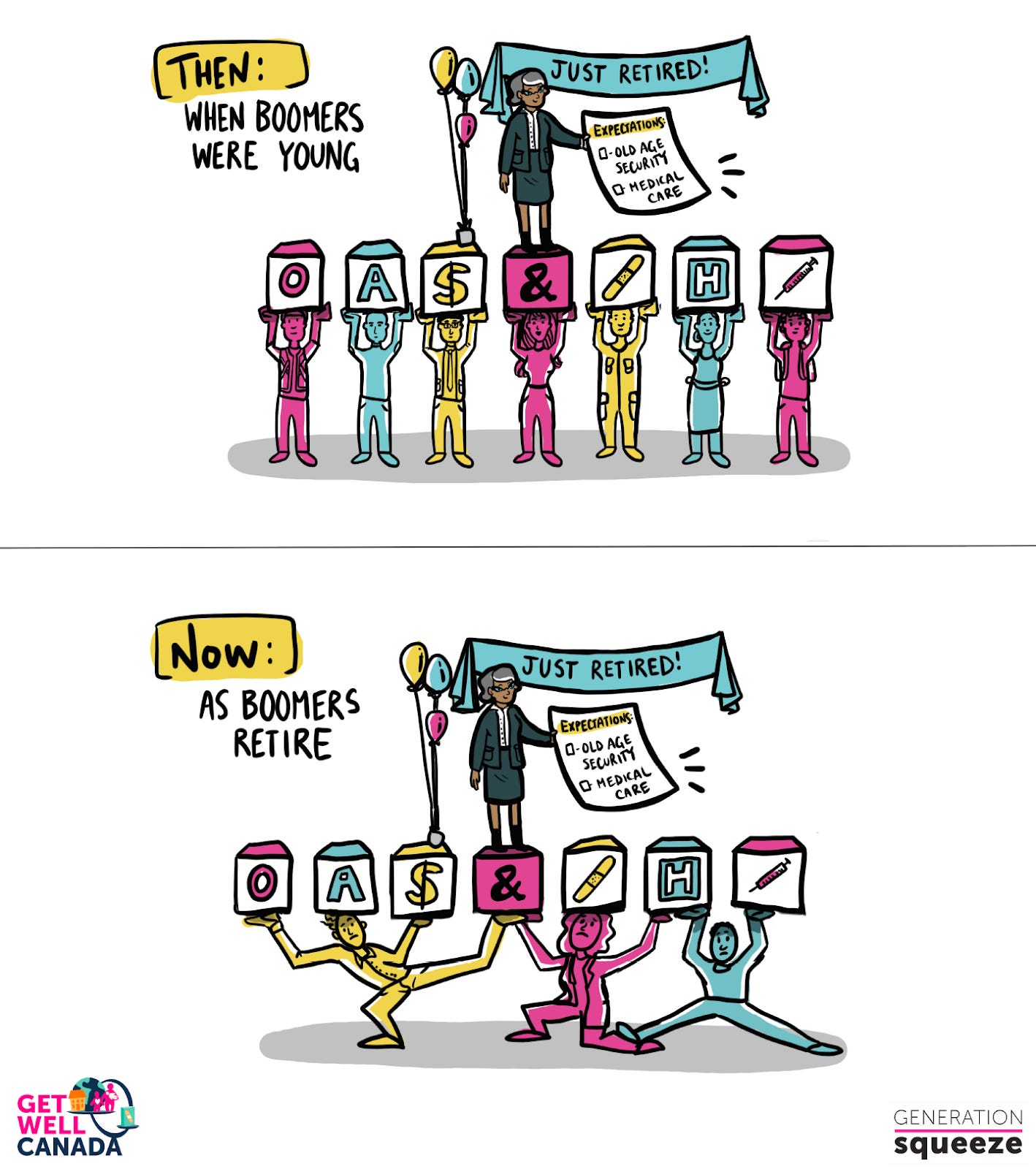

“Continuing to provide high-quality medical care is one of the fastest growing costs facing us collectively, primarily due to our aging population… In the 1970s, there were seven working-age adults for every retiree. Now, there are only three. That made it easier in decades past for the province to cover the medical-care costs of our aging loved ones.”

Governments across Canada are running deficits now to compensate for the fact that there are fewer working people paying the taxes needed to cover costs for a growing number of retirees. This is taking a toll not only on public finances, but also on the wellbeing of younger and future generations.

BC’s most recent budget announced larger deficits over the next three years than during the pandemic. The cost to cover interest payments on this debt is more than the combined investments in child care and housing — priorities for BC families facing rising living costs.

As Paul observes in his article, many people are open to getting our government budgets back into balance through measures like increasing productivity, slowing spending, or taxing the ultra-wealthy. It’s likely that these steps will be necessary — and can yield other positive effects, like reducing wealth inequality.

But the hard truth is that eliminating wasteful spending (ArriveCan anyone?) and taking back control of our economy from billionaires will not be enough to offset the rising costs of medical care and income security for today’s large group of retirees.

By his own party’s numbers, NDP Leader Jagmeet Singh’s proposal to add a 1-per-cent tax on net wealth more than $10-million would raise $13.1-billion a year. That’s not even half the value by which Old Age Security (OAS) alone is projected to grow between now and 2028.

The Parliamentary Budget Officer just flagged that spending on elderly benefits in 2024-25 will surpass the $80-billion mark for the first time, rising to $81.1 billion — many times more than Galen Weston’s net worth. It’s no wonder that more than 80 percent of the federal deficit can already be accounted for by spending on old age security (OAS) and medical care for retirees. Or that by 2028, Federal government projections show that about $1 of every $5 in the federal budget will go to OAS.

Paul’s message to older affluent Canadians:

Your use of taxpayer-funded programs is peaking at a time when you also have more wealth than other age groups, including housing equity. You are at a stage of life where legacy matters, and you don’t want it to be unpaid government bills, or too little investment in your grandkids.

…we need to harness your wisdom, self-interest and love for your offspring to help make it fashionable to talk taxes once again — just like it was in the sixties. Bring it to your book clubs, wine events, pickleball tournaments and especially to your politicians.

Because your generation’s retirement income security, medical care and legacy all depend on fixing the structural deficits that no government can avoid, regardless of party stripe.

In response to Paul’s article, we received numerous supportive letters from generational fairness mavens across Canada — letters which they also shared with The Globe and Mail. We’ll be featuring the voices of these leaders in the days and months to come, to show decision-makers what Canadians think is needed to make our country work for all generations.

Richard Patterson from Collingwood, Ontario rightly observed that things aren’t looking good for younger and future generations:

Your Saturday article (“Boomers, will you help make talking tax sexy again?”) articulated the indefensible burden that is being imposed upon the young adult generation. Most boomers, myself included, used to believe that our children would be better off than us, our grandchildren even more so. But, as the Kershaw article shows, with demographic change, marginal economics, and skewed taxation, that dream is simply unrealistic. Indeed, the reverse is true; we boomers have grabbed the biggest slice of the pie and left a diminished world for our progeny. Time to start thinking about — and addressing — our legacy.

William Loucks, CA, CPA from Chatham, Ontario pointed out the absurdity of high-earning seniors receiving OAS payments:

Most Boomers, including myself, are opposed to wasteful government spending. I can’t think of any spending that is more unfair or wasteful than when the federal government makes OAS payments to wealthy seniors. Young people in the workplace are paying taxes and watching the national debt increase while Boomers who are earning up to $153,771 each or over $300,000 per couple and have fewer financial obligations than younger Canadians can receive OAS payments.

Payments to wealthy Boomers are especially egregious when you consider that the clawback of OAS payments only starts at incomes in excess of $90,997 per person while the Child benefit clawback begins when family income exceeds $34,863. How can anyone possibly claim that a senior couple with an income of $181,994 needs government support more than a family of three earning $34,863?

As Boomers we need to support our children and grandchildren by encouraging politicians who are brave enough to significantly reduce the amount that seniors can earn before their OAS payments are reduced so that only seniors who are truly in need receive these payments.

This change should appeal to both politicians on the left who want to tax the rich as well as to politicians on the right who want to eliminate wasteful unnecessary expenditures. Sadly, the only way this will happen is if another politician like Brian Mulroney comes along who is willing to do the right thing rather than the popular thing.

Old Age Security helped reduce poverty among seniors to the lowest of any age group. Now that young people are generally financially worse off, Ginette Holland from Vancouver, BC suggests that it might be time to introduce a “Young Age Supplement.”

As a boomer, Paul Kershaw’s article on taxation conversation, made me reflect on taxes, services, and generational responsibility.

No one likes to pay taxes, and paying more certainly would face resistance. Yet, when our services lack the quality we expect, we recognize the importance of funding.

In our day, with more working age adults footing the bill for retiree benefits and services, we have been essentially ‘kicking the bill down the road’.

Similarly, there is more ‘kicking the bill down the road’ when governments take on huge amounts of debt to pay for today’s retiree medical care and OAS benefits.

Do seniors with high income levels need to receive OAS welfare as they do today?

Tax spending must more fairly focus on addressing critical issues younger generations face: unaffordable housing and high cost of living, and unless we make changes: structural government debt.

If that means less for people who have already acquired wealth needed to support their remaining life in comfort, and more for younger generations then so be it. Maybe it’s time for a “Young Age Supplement”.

We’re always thrilled to receive letters like these, so please keep them coming! Not only do they provide great policy insights, but they also help counteract the negative comments our articles about taxes tend to attract, like this one from the infamous cat-bedroom braggart:

Dedicated advocates publicly supporting our work by sharing, commenting, and writing letters raises awareness about Canada’s broken generational system. The more awareness there is, the more quickly things will change. So, if you’re able, we would appreciate your help as well!

Without considering the overall tax impact and looking at net costs, these "cherry picked" budget line items are irrelevant and misleading. OAS is taxable. Plus, RRSP's are fully taxed as single year income upon death. There is a lot more to consider here. Is it out of balance? Absolutely. Is it as bad as claimed, likely not but can't be determined until all variables are included.

Sometimes I feel like people see the statistic about the number of workers to retirees when boomers were young, but think it's the current situation that is abnormal demographics. The current ratio of workers to seniors is about what you would expect if all generations were the same size when they were born! On average people spend 17 years retired, and 50 years in whats (maybe too broadly) defined as working age. The average person spends about three times as long working-age as over 65, so that would be about the ratio of workers in a stable population. (They weren't the same size, but the difference was already mostly made up by immigration.)

It's true that governments didn't plan for boomers to retire. But the whole structure of our safety nets, many put in place in the 60s as boomers were reaching adulthood, was basically made possible by boomers being such a huge demographic relative to their parents and simultaneously having fewer children than their parents did (so relatively less public resources were needed for spending on children). Governments didn't plan for that to end, but it was always an unusual (or transitional) situation.