Do We Really Still Think Expensive Lattes Are Why Young People Can’t Afford A Home?

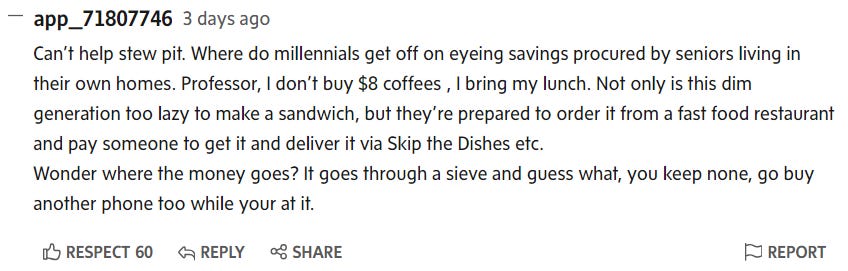

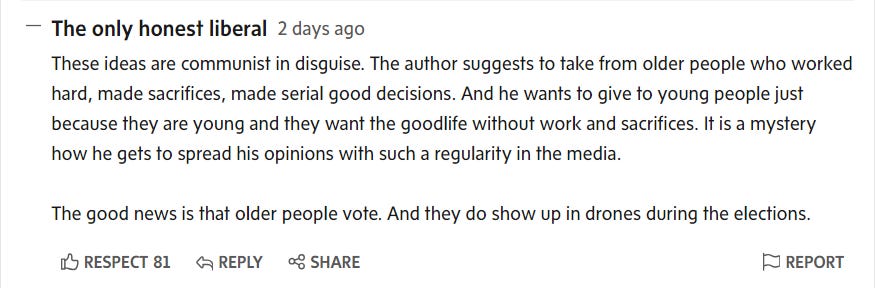

Backlash from readers of the Globe and Mail

“Class dynamics have been transformed in Canada. Income now matters less. Home equity matters more, especially for those who bought decades ago.

Older Canadians worked and lived in an era when blue-collar jobs could pay enough to purchase a home. With the wealth they have since acquired from rising home values, many have ascended to the ranks of the affluent.”

The intro to GenSqueeze founder Paul Kershaw’s latest column in the Globe and Mail sounds like a pretty reasonable, fact-based statement, doesn’t it?

Well, many Globe and Mail readers didn’t think so.

The article, which details how economic patterns within our society have shifted over the last few decades due to rising home prices, struck a nerve with many readers.

What these commenters miss is that hard work no longer pays off the way it used to for previous generations.

Of course older folks worked hard to get where they are – we’re not denying that. But at the same time, the evidence makes it hard to deny that things have gotten harder.

In 1976, it took a typical full-time income earner 5 years to save up for a 20% down payment. As of 2022, it would take 17 years! Blaming the inability of young people to afford a home on poor financial habits, like buying too many lattes or lunches, is a severe misdiagnosis of the problem. It’s especially troubling when such claims are made by older folks who have joined the ranks of the wealthiest people on earth because of the same surging home prices that have locked younger people out of the market.

Despite the negative feedback on the G&M website, we know that these commenters are in the minority. We ran a survey that showed that the majority of Canadians (71% overall and 76% of those over age 55) agree that “Rising real estate prices benefit many people who already own a home by growing their wealth”. Another survey suggests that “some homeowners are willing to give up a bit of their own wealth to improve affordability for others.”

Paul describes in the article an encounter with one retiree who recognizes the difficulties young people are facing.

I was heartened by a note I received from Mike, a retiree in Victoria. He CC’d me on an email sent to Steve Ranson, the CEO of Home Equity Bank.

“I am very dismayed at your latest television commercial for CHIP Reverse Mortgages,” Mike wrote to Mr. Ranson. “It depicts a young couple, with an infant, looking longingly at a house, only to be told by a very nasty senior to get their feet off her grass. In a failed attempt at humour, it reinforces the image of my generation of seniors (I’m 72) as a group of self-righteous, cold-hearted, real-estate-rich egotists who lack any sensitivity or empathy for the struggles that young families are facing in the current housing market.”

We know that there are more people like Mike out there, and we need more of them to stand up for younger, newer, and future Canadians. If you’re one of them, we could use your help!

So tell us: how would you respond to the sort of misguided comments from G&M readers that we featured above?

If you’re older, what would you say to someone in your demographic who shared these kinds of views? What do you think might spark some different ways of understanding why younger people are struggling?

If you’re younger, how do these comments make you feel? What would you want to say to the people making these kinds of claims about your experiences?

We look forward to hearing from you.

Honestly, I feel like at this point most of the people saying this *know* they are wrong. No one wants to feel like their advantages came from luck or even unfairness, and pointing out supposed overspending gets around some of that cognitive dissonance. There's a real sense in which some older people want young people to 'play the part' of striving for a goal that is not actually attainable, like they pretend they could muster up some sympathy if young people tried harder and still failed. (But, sometimes people treat sacrifices like living with roommates longer or living at home as a failure to sacrifice.) But I know (just a few) people who have downpayments that at one time could have bought modest homes outright, and still can't afford anything appropriate for their life stage and family plans. I don't believe at this point that anyone really believes you are making up that difference in lattes, if they ever did.

But even beyond that, young people are mostly making choices that make sense for our lives. I saw a great article (https://www.newstatesman.com/politics/society/2022/02/boomer-mathematics-why-older-generations-cant-understand-the-millennial-struggle-to-buy-a-house) about how older people act like many things that didn't exist when they were young are more expensive than they are. A netflix subscription costs barely more than a single movie ticket, which would not have seemed like a wild luxury for most. Some things that seem like luxuries are substitutes for space or time or even more expensive things. An occasional delivery or uber ride is cheaper than a car, and someone buying meal kits is not necessarily any lazier than someone who (on average) had more time at home. I even increasingly know people who don't have space to cook much because there are more people sharing a kitchen. Some budgeting advice from older people feels like it's from a different world. 'Get a chest freezer to stock up on sales' and... put it where? Most people I know are making pretty reasonable trade-offs giving what is actually expensive (as much space as previous generations enjoyed) and what isn't (basically everything else).

My Dad, who has been gone since 2009 railed against the reverse mortgage adds. They embody cultural sickness. They are effective and resonate because they capture the American/Canadian greed ethic. Look to the advertising slogans and you see were the bulk of Canadian values reside. As a Kid I was struck by L’Oréal's "Because I am worth it." and E. F. Hutton's “We make money the old-fashioned way. We earn it” Humans are so vulnerable to myths-assumptions especially when they are self- justifying assumptions. The bottom line is this. We know that success is based on good fortune taking advantage from advantaged positions. Successful people have compounded advantages unsuccessful people have compounded disadvantages. The thing is to get people to give up some advantage for the disadvantaged... rather than just say would in a poll. As a consumer society rather than a civics society we are not very willing to sacrifice our positions or our time rail against the extremely advantaged keeping the disadvantaged-disadvantaged. Even though we know better we know "it's good to be King" King of the castle. “I’m the King of the castle, you’re a dirty little rascal” is the nursery rhyme that our culture was nurtured on. Yes, we have other values but this one dominates our ideology.