Risky Business: Your Tax Dollars Could Be Used To Repay Banks For Mortgages Gone Bad

We need to rethink the federal government's mortgage backstop, which fuels our economy's dependence on real estate and contributes to skyrocketing home prices

Last year, Gen Squeeze founder Paul Kershaw wrote in The Globe and Mail about how Canada’s economic growth has become overly reliant on real estate:

“Anchoring our economic prosperity on real estate, rental, and leasing would be a fine economic development strategy if Canada was also generating a large portion of its employment in this same industrial sector. But we don’t. Fewer than 2 percent of Canadians make their living in the real estate sector.

This gap highlights a major economic weakness – one that contributes substantially to Canada suffering very slow improvements to GDP per person compared with other large economies. The gap reveals that Canada has been growing our economy by increasing the major cost of living, without generating jobs in that industrial sector at a rate that ensures local earnings keep pace, especially in urban centers.”

The solution?

“...a shift in lending and borrowing from mortgage loans to business loans.”

This got me thinking: why are banks more willing to lend out mortgages than business loans? I wrote a blog post explaining what I found, which I think will surprise you. Canadian banks love to give out mortgages because doing so is, in many instances, risk-free.

All high-ratio mortgages (those with a downpayment of less than 20%) in Canada must be insured. For these risky loans, by law, banks need to be protected against losses incurred in the case of default (when a borrower stops paying their mortgage). Mortgage insurance transfers the risk of default from the lender to one of three main insurers: the government-run Canada Mortgage and Housing Corporation, or privately owned insurers Sagen and Canada Guaranty Mortgage Insurance Company.

For a small portion of the premiums collected by insurers, the federal government backstops (guarantees) all mortgage insurance contracts. This leaves taxpayers on the hook if a high-ratio borrower defaults on their mortgage, and the insurer hasn’t collected enough premiums to cover losses the bank who lent out the mortgage might face.

Why would banks lend to businesses that might fail to pay back loans and leave the bank out of pocket, when they can focus on mortgage lending made risk-free by a federal guarantee?

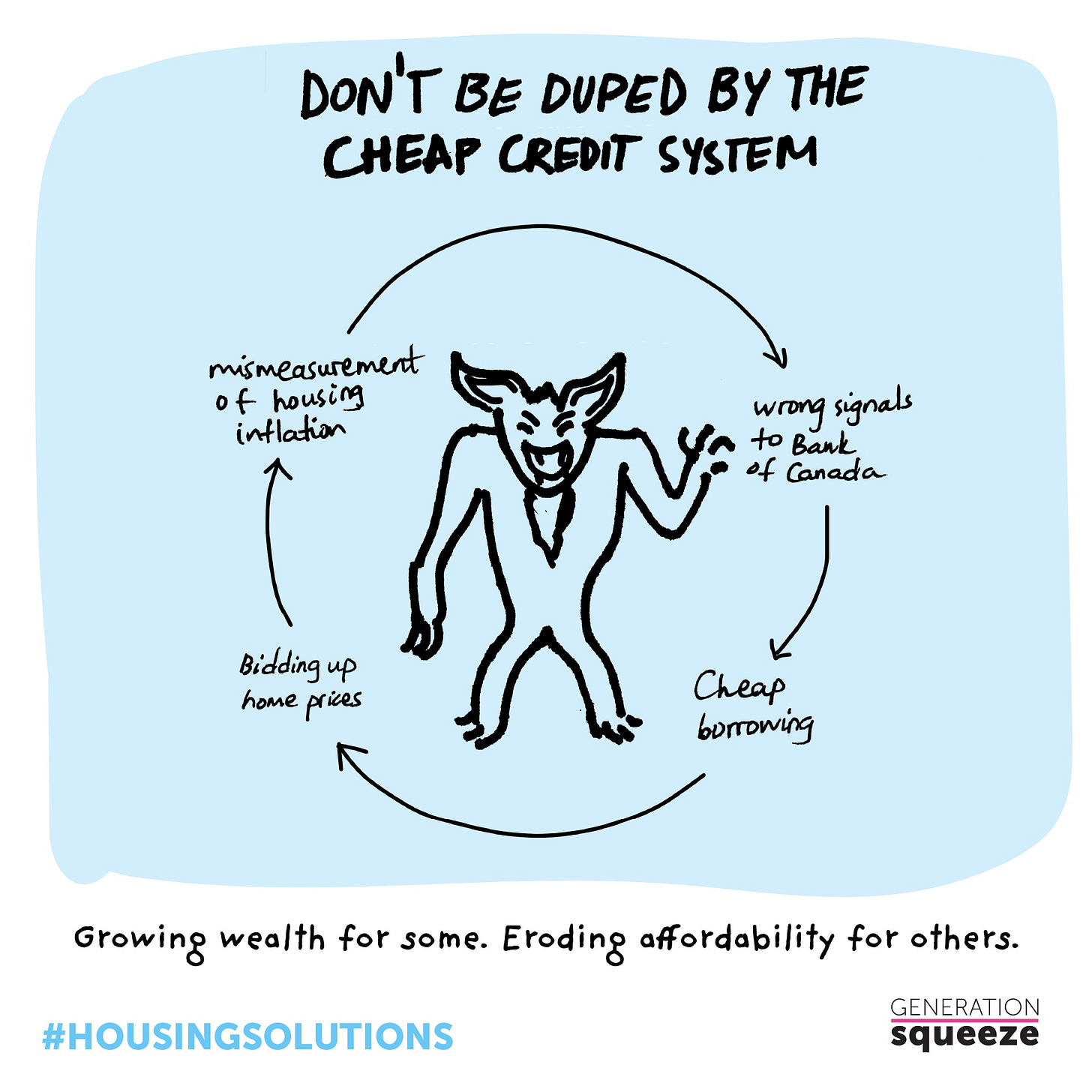

The federal guarantee of high-ratio mortgages drives down mortgage rates, helping to support the cheap credit system. Cheap credit fuels skyrocketing prices by giving everyone access to large mortgages that can be used to bid up home prices. Without the backstop, mortgage lending wouldn’t be so attractive for our banks. More money could be lent out to industries other than real estate, helping to create a stronger and more balanced economy – and disrupting the cheap credit system.

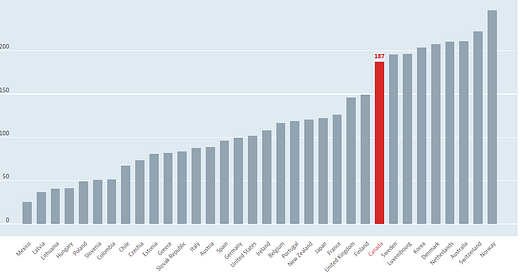

Canadian households are some of the most indebted in the world. It’s often thought that this is because of our high home prices. But what if home prices are high because we have so much debt available to us?

Some economists would agree with this view. David Williams, Vice President of Policy at the Business Council of British Columbia, has written about how Canadians accumulated an incredible $481 billion of new mortgages from 2016 to 2021, increasing the total amount of mortgages outstanding by 35% in just 5 years. Our leaders continue to treat supply as a silver bullet to solving our housing affordability issues, yet according to Williams, the availability of cheap credit played a larger role than a lack of supply in driving up home prices.

We need to rethink the federal government’s mortgage backstop. It doesn’t deliver any clear benefit for the housing system and puts our public finances at risk.

Before we sign off, we also want to let you know about our newest Hard Truths episode with Joe O’Connor, a leader in the global work-time reduction movement.

Kareem, as usual is right on the money. Cause and effects are really hard to sort out when we have made a complex monster out of our whole banking-financing system. Alan Greenspan, chairman of the Federal Reserve from 1987 to 2006 pointed out that not even he saw the mortgage -backed bubble that caused the 2008/09 bubble. Re-packaging, creating new financial instruments and speculation had removed banking from easier to track, easier to understand purposes. It did so not to serve original good purposes-savings and loans-investments in businesses. It did so to do the opposite to make speculation and create instruments that served those who made careers out of the financialization of the economy to make profits that added nothing real and productive to the real economy. Our financial system is in fact pyramid schemes a complexity that has our best grads from Business schools and law schools going into this big speculation complex making money off of money complex-far removed and siloed away from serving original purposes of banking but the self-serving purpose of getting rich quick.

Here Kareem isolates the Federal governments mortgage backstop that fuels our dependence of real estate contributing to grossly inflated home prices. We have financialized housing market-made unnecessary complex for the wrong reasons. The financialization of the housing industry has replaced the original purpose- the providing houses as homes not as investments- get rich quick schemes.

Our economy's dependence on real estate rather than businesses-rather than investing in businesses is a fool's paradise...extremely ill productive not only leaving so many Canadians unable to afford a home-homeless but makes the world look at Canada not as a serious industrious nation but a nation built more and more on nothing much at all but real estate speculation.

Bingo!!!! But have any politicians ever discussed this?? No. Why? Because they lack depth of market and financial comprehension.