Answering your questions: How do we analyze spending by age in the federal budget?

A Gen Squeeze network member recently wrote to us to ask for more information about our analysis of spending by age in the recent federal budget. She wanted to know how we concluded that the bulk of new federal spending goes to supporting retirees ($190 billion by 2027/28).

This is a great question, so we thought we’d share the answer with everyone. We really wish that federal budget documents made it easier for individuals and organizations to understand how spending breaks down by age – rather than relying on Gen Squeeze to do this analysis. We’ve long been recommending that federal and provincial governments should include an age analysis as part of standard budget tables.

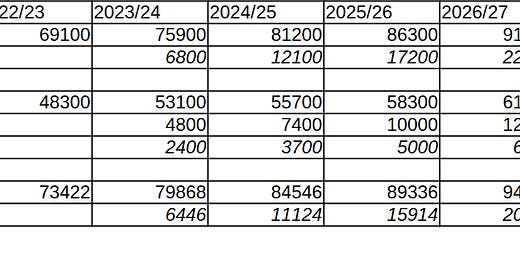

For this year’s federal budget, the key place to look is table A1.7 on page 212. We’ve used these data to help create the summary table below, to spell out how it is that retirees receive $190 billion in new spending.

The first two lines feature ‘elderly benefits,’ which include Old Age Security (OAS) and the Guaranteed Income Supplement for seniors. These data show that spending on elderly benefits will increase by $85.6 billion in aggregate over the next 5 years.

The next three lines are budget figures for the Canada Health Transfer. As outlined in the table, federal spending on medical care overall will increase by $49.3 billion over the next 5 years.

To understand the portion of this medical spending for retirees, we rely on data from the Canadian Institute for Health Information. These data show that the 20% of Canadians who are over age 65 currently use half of all medical spending. This means that Budget 2023 adds a little over $24.5 billion to medical care for retirees.

Spending on retirees in 2023 federal budget (figures are in millions of dollars)

Increased spending on the Canada Public Pension plan (CPP) is included in the final two rows of the summary table. These data come from the 2022 Actuarial Report on the Canada Pension Plan. Tables 10 and 11 in this report show that CPP spending will increase by $79.9 billion over the next five years.

So together, new spending on OAS, medical care and CPP add up to an extra $190 billion over the next 5 years, compared to what spending would have been had they remained at levels in 2022/23.

Projected spending on retirees (elderly benefits + half of CHT + CPP/QPP)

New CPP spending is based relatively closely on contributions that retirees made during their working years. This is a well-designed program from an intergenerational perspective, because it doesn’t leave large unpaid bills for the generations that follow.

Unfortunately, OAS and medical care don’t follow the design wisdom of the CPP. These programs did not ask Baby Boomers to pay enough taxes during their working years to cover the full cost of the income supports and medical care they will use in retirement. Check out this recent Globe & Mail column for more.

The fact that increases in OAS and medical spending aren’t covered by the taxes today’s retirees paid during their working years has clear intergenerational tensions. When the large Baby Boom generation started out as working adults, there were seven working age residents paying taxes to support programs and services for every retiree. Now there are only 3. With OAS and medical care costs growing in response to population aging, the unpaid bills of boomers are being left for younger and future generations to pay.

It’s no surprise that politicians want to avoid talking to boomers about taxes, because that’s a risky business come election time. But we have to find a way to overcome this reticence by returning to the question: Why did we change taxation for CPP decades ago but not for OAS and medical care? And what can be done now to raise additional revenue for medical care and OAS from (affluent) boomers to compensate for the lack of adaptation decades ago?

If we don’t engage with these questions, we will remain en route to securing the wellbeing of many boomer Canadians at the expense of undermining the financial security of those who follow in their footsteps.